Top Guidelines Of Feie Calculator

The 6-Second Trick For Feie Calculator

Table of ContentsNot known Factual Statements About Feie Calculator What Does Feie Calculator Mean?The Of Feie CalculatorFeie Calculator for BeginnersThings about Feie Calculator

He marketed his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his spouse to assist meet the Bona Fide Residency Examination. Neil directs out that buying residential property abroad can be challenging without first experiencing the place."We'll absolutely be outside of that. Even if we come back to the United States for doctor's appointments or organization calls, I doubt we'll spend even more than thirty day in the US in any type of provided 12-month duration." Neil emphasizes the importance of strict tracking of united state sees (American Expats). "It's something that people need to be really attentive concerning," he claims, and advises deportees to be mindful of common mistakes, such as overstaying in the united state

Feie Calculator Things To Know Before You Buy

tax obligation responsibilities. "The factor why U.S. tax on around the world earnings is such a large deal is since many individuals forget they're still subject to U.S. tax even after relocating." The united state is one of the few countries that tax obligations its citizens regardless of where they live, meaning that even if a deportee has no earnings from U.S.

income tax return. "The Foreign Tax obligation Credit scores allows people functioning in high-tax countries like the UK to counter their united state tax obligation by the amount they have actually already paid in taxes abroad," claims Lewis. This makes certain that deportees are not taxed two times on the very same income. However, those in reduced- or no-tax countries, such as the UAE or Singapore, face additional hurdles.

Get This Report on Feie Calculator

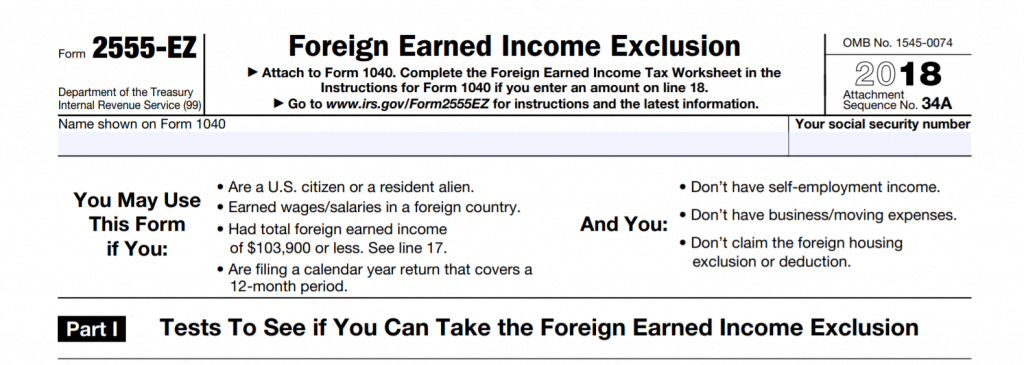

Below are some of one of the most regularly asked concerns regarding the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) allows U.S. taxpayers to leave out up to $130,000 of foreign-earned income from government revenue tax, minimizing their U.S. tax liability. To receive FEIE, you must fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic Residence Test (verify your key residence in a foreign nation for a whole tax obligation year).

The Physical Visibility Examination additionally needs U.S (American Expats). taxpayers to have both an international earnings and an international tax obligation home.

Excitement About Feie Calculator

A revenue tax treaty between the united state and an additional country can help prevent resource double taxes. While the Foreign Earned Revenue Exclusion decreases taxable earnings, a treaty might offer fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Report) is a required declaring for united state citizens with over $10,000 in international economic accounts.

Eligibility for FEIE depends on meeting particular residency or physical visibility tests. He has over thirty years of experience and now specializes in CFO solutions, equity settlement, copyright tax, marijuana tax and divorce relevant tax/financial preparation matters. He is a deportee based in Mexico.

The foreign earned income exemptions, in some cases described as the Sec. 911 exclusions, exclude tax on earnings made from functioning abroad. The exemptions make up 2 components - an earnings exclusion and a housing exemption. The complying with Frequently asked questions discuss the advantage of the exclusions consisting of when both spouses are deportees in a general way.

The Facts About Feie Calculator Revealed

The tax advantage leaves out the revenue from tax obligation at lower tax obligation prices. Formerly, the exemptions "came off the top" lowering revenue topic to tax obligation at the leading tax obligation rates.

These exclusions do not excuse the incomes from US tax yet just give a tax reduction. Keep in mind that a solitary person working abroad for all of 2025 who earned regarding $145,000 without any other income will certainly have taxed revenue minimized to absolutely no - effectively the very same solution as being "free of tax." The exclusions are calculated on a day-to-day basis.